Gift Tax Rates 2025 In India. In such a case, the taxable amount will be stamp duty minus the consideration value, i.e. If you receive gifts exceeding this amount, the entire gift becomes taxable.

Estate and Gift Tax Changes Coming in 2025 Karp Law Firm, For example, if an individual receives a gift amounting to rs. Gifts are of three types monetary (like cash), immovable property, and movable property, calculate gift tax on all possible scenarios, learn more.

Tax rates for the 2025 year of assessment Just One Lap, Tax exemptions on aircraft or ship leasing from the ifsc centre has also been extended. Visit our website for more information.

Individual Tax Rates 2025 Ato Calla Corenda, For instance, if you receive gifts or cash of up to rs. Might receive an unexpected incentive in budget 2025—financial incentives to upgrade the skills of their workforce.

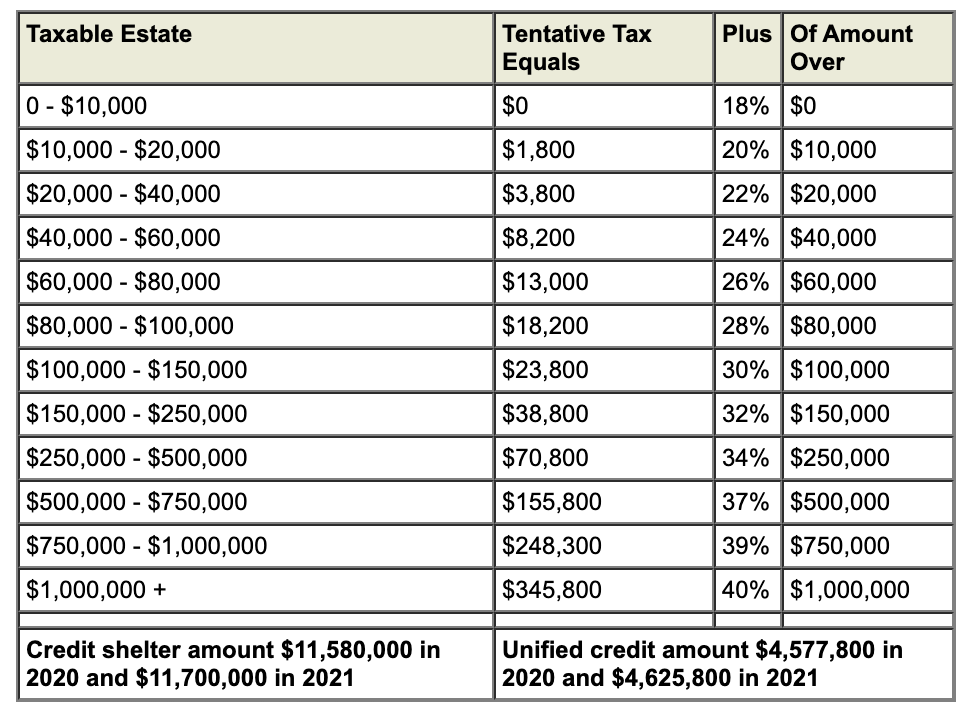

Did you receive Gift? Are Gifts Taxable in India? Examples & Tips, The first major rule which every person should know is that there is no tax to be paid on giftsreceived (cash or kind), if the amount of the gift is upto rs 50,000 in a year. When calculating gift tax, you will need to know the gift value that exceeded the annual exclusion limit to determine the corresponding rate which ranges from 18% to 40%.

Gift Tax 2025 Rate Vina Aloisia, Gift tax rates for 2025. Discover the nuances of gift deeds in india, from stamp duty rates to tax implications.

Us Gift Tax Rate Table, When calculating gift tax, you will need to know the gift value that exceeded the annual exclusion limit to determine the corresponding rate which ranges from 18% to 40%. This blog post covers the exemption list, provisions, and tips on how to save on gift tax.

HOW TO SHOW EXEMPT/TAXABLE GIFT ON ITR 1,2,3,4 EXPLAIN ABOUT GIFT, Suppose the stamp duty is rs. A moneycontrol analysis shows that the gap between 30% tax rate and the per.

2025 Estate Planning, Gifts in other cases are taxable. Learn about gifting a property, gift tax rates, exemptions, and the tax implications on monetary gifts.

2025 Tax Brackets Mfj Roch Violet, 50,000 per annum are exempt from tax in india. Upto rs 50,000/year is not taxable.

2025 Tax Rates TWHC, Gift tax rates in india. Stay informed on the tax landscape for nris receiving gifts in india.